We have forged new paths – new ways of doing things – so you no longer have to, allowing you to concentrate on what you do best, knowing that your business, at least this part of it, is in good hands.

Higher Engagement

AI-driven, our workflows are fully adaptive, allowing us to proceed with the most appropriate treatment channel and communications based on data related to the customer’s interaction and behaviours. So the customer’s response will determine what happens next, ensuring the best outcome.

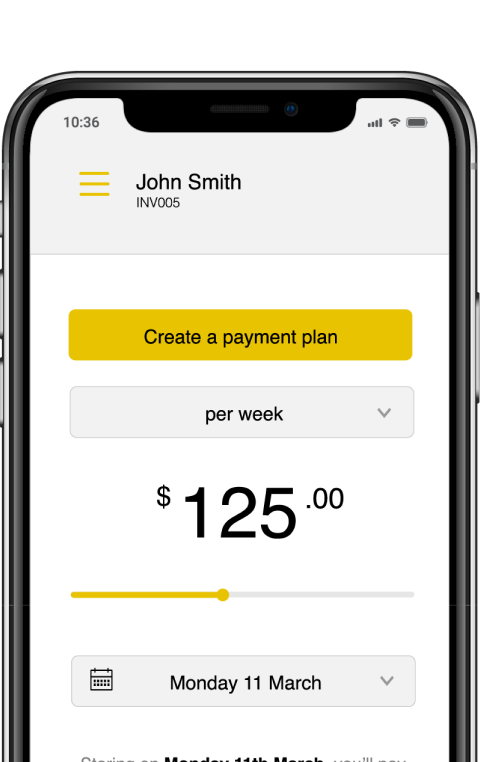

More choice. Frictionless Repayments

On average, it takes less than two minutes to set up a smart payment plan and no manual intervention is required. It’s even quicker to pay in full, request a callback or ask for more information.

More choice. More payment options. More resolutions.

Better insight

Live transactional activity feeds can be provided, where you can view the digital paper trail created on each customer to see their activity and engagement in real time.

Predict repayment behaviour and forecast future cashflows with greater certainty.

We’ll help you choose the

optimal strategy for your business.

Initial Assessment

When you engage our services, our team of experienced professionals begins by conducting a thorough assessment of the portfolio. We’ll review all relevant documentation, including contracts, invoices, and any other supporting materials.

This assessment will help us gain a complete understanding of the debt, its history, and any potential challenges that may arise during the collection process.

Case Studies

We’ll share with you our insights and learnings into the strategies that have worked with similar debt portfolios. We have subject matter experts covering all industry sectors and would welcome the opportunity to discuss the challenges and issues we’ve faced, and how we’ve overcome them.

Before we start, we want you to be confident that you’re dealing with a company that knows what it’s talking about.

Compliance Framework

Before undertaking any action on your behalf, we’ll ensure that any of your relevant policies, procedures, and frameworks are embedded into our own.

This is particularly important for things like financial hardship and vulnerable customer management, where it’s important that there’s a consistent approach and customer experience. We’re always happy to share our own policies if you don’t have them.

Getting started couldn’t be easier

1

Choose your solution.

Each solution is fully customisable and can be offered as a stand-alone service or integrated into a broader recovery strategy.

2

Agree on terms.

We’ll work with you to develop to a service-level agreement with key performance metrics (optional) to meet your business objectives.

3

Implementation planning.

Whether you’re switching providers or starting from scratch, we’ll develop a comprehensive project plan so we can hit the ground running.

We’re inviting you on our journey to become leaders in best practice debt recovery.

Communication with the Customer

Verification and Negotiation

Establishing Repayment Plans

Legal Measures (if necessary)

Recovery and Reporting

Ethical Practices

Communication with the customer

Once we’ve gathered all necessary information about your customer base, we’ll develop a communications strategy combining both digital and human-led channels. We take a respectful and diplomatic approach, aiming to establish open lines of communication. We understand that each customer’s situation is unique, and our team members are trained to adapt their communication style accordingly.

Verification and negotiation

During the initial communication, we’ll verify the customer’s identity and discuss the debt details. Our team works closely with customers to understand their financial situation and explore possible solutions. We’ll strive to reach a mutually agreeable arrangement that satisfies all parties. Our negotiators are skilled in employing effective persuasion and mediation techniques to encourage customers to fulfil their obligations.

Establishing repayment plans

If the customer acknowledges the debt but requires a structured repayment plan, we’ll work closely with them to establish a feasible arrangement. Our team carefully evaluates each individual’s financial capacity to ensure that the proposed plan is realistic and will lead to a successful resolution. We aim to strike a balance that allows customers to repay their debts without causing undue financial hardship.

Legal measures

In cases where customers fail to respond or refuse to cooperate, we may suggest escalating the matter by pursuing legal action. Our account managers experts are well-versed in applicable laws and regulations governing debt collection practices and will work closely with our inhouse law firm, Oakbridge Lawyers, to determine the best course of action.

Recovery and reporting

Once an agreement or court order has been established, we’ll monitor the customer’s progress in meeting their repayment obligations. Our team ensures that payments are made according to the agreed-upon schedule and promptly reports any discrepancies or delays to all parties. We’ll provide regular updates and detailed reports to keep you informed about the progress of each individual account.

Ethical Practices

Throughout the entire debt collection process, we strictly adhere to industry regulations and guidelines, prioritising professionalism, respect, and fairness in all our interactions with customers. At ARMA, we believe that effective debt collection goes beyond simple recovery; it requires a compassionate and comprehensive approach. Our commitment to excellence, service and ethical practices sets us apart, allowing us to provide tailored debt collection solutions that yield positive outcomes for both our clients and customers.

Get in touch today

The evidence is indisputable – the earlier a debt is referred for collection, the greater the chance of recovery. Book a no-obligation consultation and find out how we’re helping more and more businesses recover their debts with our smarter, faster, more innovative approach to debt resolution.