Digital

Today’s customers want to be able to control their finances themselves using self-service tools that are easy to use and available when they need it. They want to be able to find information, propose solutions and manage their payments at their 24/7 convenience in a format that gives them complete control.

And now they can.

We’ve built a platform that maximises repayments from customers

Our technology-enabled communications platform is helping businesses drive smarter, faster and more innovative financial outcomes by changing the way people manage their repayments. Through the simple act of digitising and customising the process of invoicing, we have eliminated the need for multiple notices and payment avoidance. Repayments are now about forming a relationship with your customers and replacing the stress and pain of payments with flexibility and choice.

Maximising Repayments

ARMA does more than deliver an engaging digital message to a customer to remind them about a repayment. We are investing heavily in decoding the art of maximising repayments from customers using data and artificial intelligence.

Superior results

We have years of repayments data from customers in multiple industries and we combine that with behavioural analytics to get a superior result for our clients over traditional methods.

Engagement Variation

This means that over time our solution more than pays for itself when it comes to return on investment. We offer a variety of engagement models to suit the needs of our clients and the nuances of their industry.

The most advanced customer engagement and repayments platform

ARMA does more than deliver an engaging digital message to a customer to remind them about an overdue account. We have invested heavily in decoding the art of maximising repayments from customers using data and artificial intelligence. We have years of payment data from customers in multiple industries and we combine that with behavioural analytics to get a superior result for our clients over traditional methods. This means that over time our solution more than pays for itself when it comes to return on investment. We offer a variety of engagement models to suit the needs of our clients and the nuances of their industry.

Intelligent Communications

80% of customer payments are within a day of engaging with our digital communications. We have invested deeply in artificial intelligence and behavioural analytics capabilities to achieve superior performance for our clients. Through intelligent and ongoing analysis of customer behaviour, we’re able to choose the best times, methods and messages to initiate payments. With a constant feedback loop, the system can continue to learn and adapt into the future.

Return on Investment

On average our clients realise a return of 7x their investment. We offer them a variety of engagement models to suit their needs and our repayment performance lift means our solution pays for itself. With a proprietary intelligence system combined with a broad variety of payment options, users have the most flexible and seamless payment method in the world, increasing debt resolution challenges whilst improving our clients’ cash flows.

Customer Experience

55% of customers that engage, do so on the first message. Our solution is the most frictionless platform for repayments, enabling customer engagement across the widest variety of channels with flexible repayment options. Using thousands of data points to better engage with each individual user via a preferred platform and time that is most likely to get a positive response, allowing us to provide an experience like no other system.

How it works

AI-Engine

Campaign and workflow engines recommend the next steps based on interaction, curating messaging and timing to maximise repayments.

Customised workflows

Tailored customised steps and interactions with your customers to ensure a high level of engagement and customer satisfaction.

Performance reporting

Live activity feeds are intuitive dashboards provide deep insights into campaign performance and repayment tracking.

Unlimited accounts

Use digital channels to communicate to all your accounts with no limit to the number of customers you can engage.

White labelling

Communicate to your customers using your organisations logo and branding, throughout the entire user experience.

Net Promoter Score (NPS)

Constant and comprehensive collection of feedback on the repayment experience allows us to continuously improve our service.

WhatsApp messaging

Repayment messages direct to WhatsApp accounts in addition to email and SMS, increasing the chance of engagement and response.

QR codes

Make repayments easy by inserting QR codes on repayment notices to enable customers the ability to quickly scan and re-pay through the app.

How users rate their digital experience.

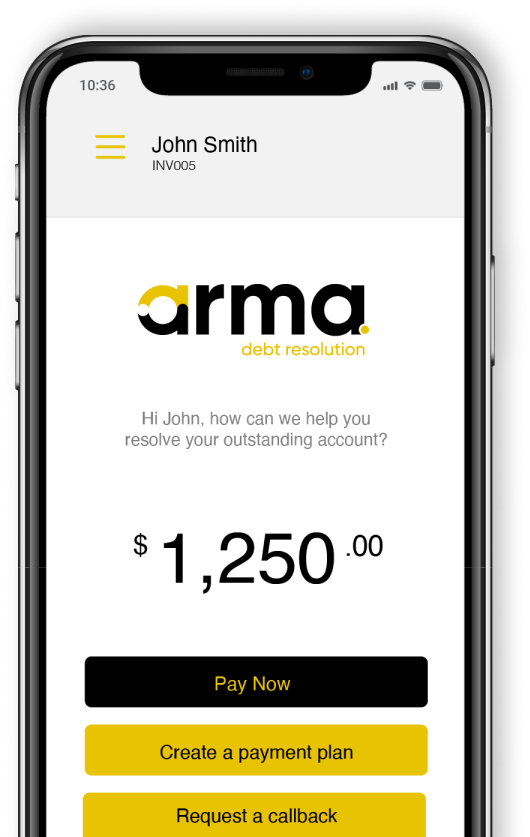

Payment options

Pay Now

Customers can make payment in full straight away through a wide range of options, including your own payment gateway.

Pay Some

Customers can choose to pay part of their repayment amount now and the rest later.

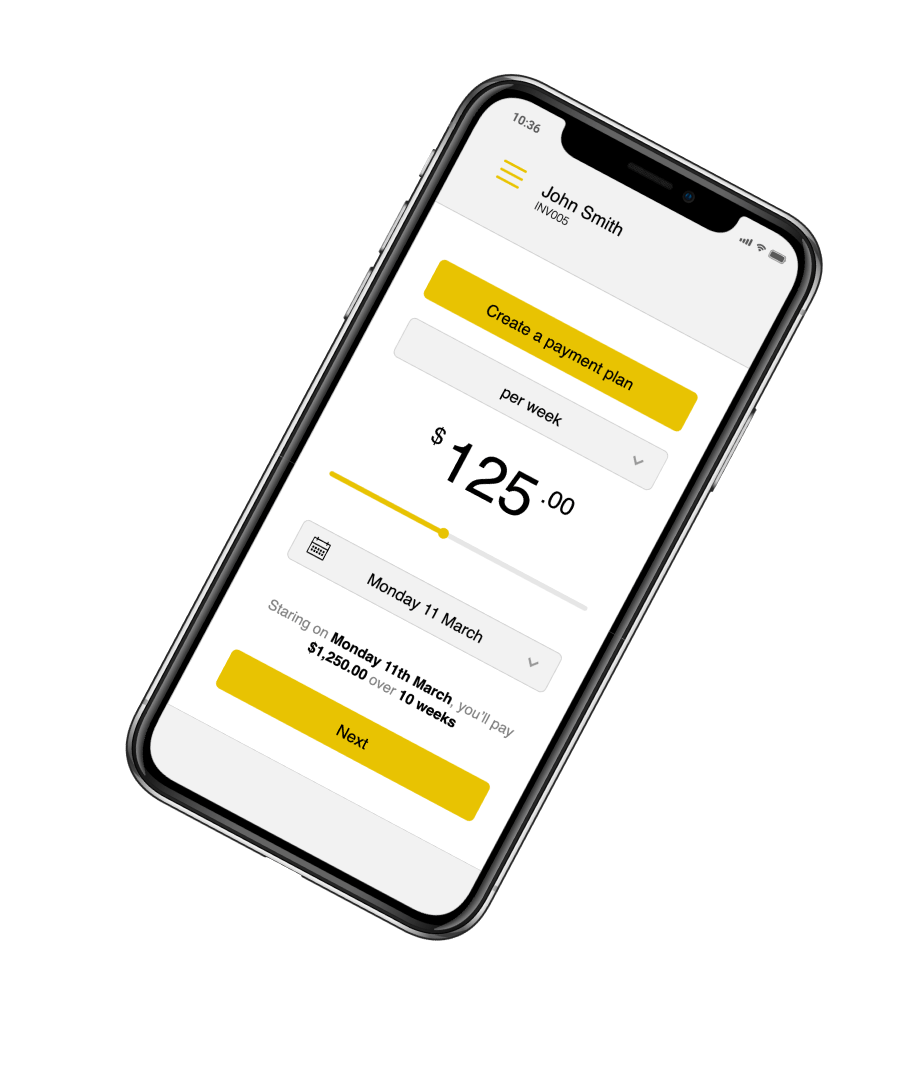

Scheduled Payments

Make payments on a specific date to coincide with pay cycles and financial commitments providing customers more control of their finances.

Make On Offer

Customers can offer a percentage of the full amount for acceptance, increasing the likelihood of repayment.

Payment Plan Engine

Smart payment arrangement system allows customers to pick an amount and frequency of payment to work around their financial commitments

Hardship solutions

Built in hardship measures enable you to handle customers unable to make repayments providing easy to implement socially responsible solutions.

Inbuilt dispute management

Create a digital dispute process so customers can easily dispute a repayment through the app using an inbuilt dispute form.

ApplePay

Allowing easy and immediate payments via ApplePay increase the chance of customers making repayments quickly and reliably.

Want to find out more?

Our team is happy to answer your sales questions. Just fill out the form and we’ll be in touch.